Amortization formula accounting

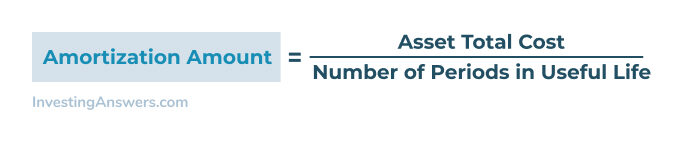

Essentially amortization describes the process of incrementally expensing the cost of an intangible asset over the course of its useful economic life. Formula initial cost à useful life.

Depreciation Formula Calculate Depreciation Expense

Multiply 150000 by 3512 to get 43750.

. If the nominal annual interest rate is i 75 and the interest is compounded semi-annually n 2 and payments are made monthly p 12 then the rate. The general syntax of the formula is. To protect your business and operate under the law you might obtain licenses trademarks patents and other intangible.

Get Products For Your Accounting Software Needs. Amortization Expense Assets Cost Assets Useful Life. The amortization of a loan is the process to pay back in full over time the outstanding balance.

The first step is to convert the yearly interest rate into a monthly rate. In most cases when a loan is given a series of fixed payments is. This means that the asset shifts.

Ad Get Exclusive Access to Top-Tier Freelance Accounting Finance Professionals with Paro. A payment amount. Accounting Treatment and Journal Entries for Bond Discounts.

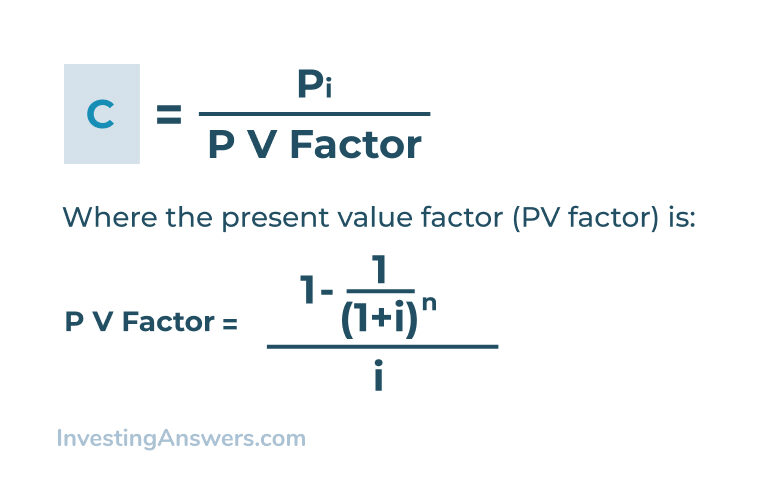

For loans the amortization formula is more complex. Amortization is the process of incrementally charging the cost of an asset to expense over its expected period of use which shifts the asset from the balance sheet to the. Thats your interest payment for your first monthly payment.

R rate of interest. The next thing to do is to multiply your principal amount with the. Subtract that from your monthly payment to get your principal payment.

The amount of amortization accumulated since the asset was acquired appears on the balance sheet as a deduction under the amortized asset. NPER Rate PMT PV 3. Ad Get Complete Accounting Products From QuickBooks.

I 100000 0005 360. Ad Get Complete Accounting Products From QuickBooks. P initial loan amount or Principal.

The formula for Amortized Loan can be calculated by using the following steps. The amortization formula under this method is as follows. This has been a guide to the Amortized Loan Formula.

Flexible Accounting Finance Solutions for Every Stage of Your Business. 612 0005 per month. While there are quite a few factors that need calculation here is the amortization.

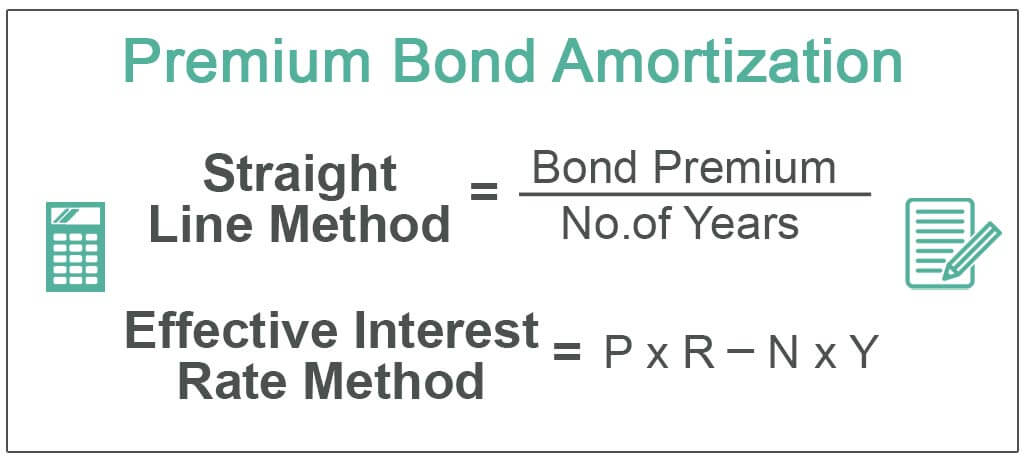

When a company issues a bond on discount the following journal entries are required. N total number of payments. The formula for bond amortization.

The NPER function aids us to know the number of periods taken to repay. Firstly determine the current outstanding amount of the loan which is denoted by P. Get Products For Your Accounting Software Needs.

In the case of our equipment the company expects a useful life of seven years at which time the equipment will be worth 4500 its residual value. Here we discuss the formula for calculation of Amortized Loan along with. In business amortization allocates a lump sum amount to different time periods particularly for loans and other forms of finance including related interest or other finance.

How To Record Amortization Journal Entries Quora

Depreciation Formula Examples With Excel Template

Amortization Meaning Examples Investinganswers

What Is Amortization Bdc Ca

Amortisation Double Entry Bookkeeping

Amortization Of Intangible Assets Formula And Calculator Excel Template

.png)

What Is Amortisation Amortisation Meaning Ig Uk

How To Calculate Amortization On Patents 10 Steps With Pictures

Bond Amortization Schedule Effective Interest Method Double Entry Bookkeeping

What Is Amortization Definition Formula Examples

Amortization Of Bond Premium Step By Step Calculation With Examples

Amortization Using Present Value Theorem Youtube

Amortization Meaning Examples Investinganswers

Straight Line Bond Amortization Double Entry Bookkeeping

How To Calculate Amortization For Intangible Assets Universal Cpa Review

How To Calculate Amortization On Patents 10 Steps With Pictures

How To Amortize Assets 11 Steps With Pictures Wikihow